|

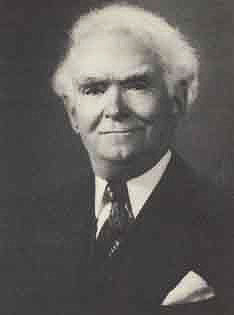

Crump

Mortgage offers a wide variety of loan programs

which enables us to find the right loan for your

individual situation.

Use

our Mortgage Calculator

to estimate your payments.

FHA

and VA Mortgage Programs

Federal Housing Administration (FHA) and Department

of Veterans Affairs (VA) loans are popular homebuyer

choices. These loans are provided by the

federal government and must meet certain

requirements.

|

FHA

Loan |

|

VA

Loan |

|

Low down payment options

|

|

|

Financing for eligible service members |

|

Available for a variety

of loan terms |

|

|

No down payment options available

|

|

Typically requires

mortgage insurance |

|

|

One time VA funding fee typically

required |

| |

|

|

|

|

|

Features:

|

|

Features:

|

|

|

Down payment options as low as

3.5% |

|

|

Flexible income, debt, and

credit requirements |

|

|

You may be able to use a gift or

grant toward closing costs and

all or part of the down payment |

|

|

Available in a variety of

fixed-rate and adjustable-rate

loan options |

| |

|

| |

|

| |

|

| |

|

|

|

|

|

Financing for qualified

veterans, reservist, active duty

personnel or eligible family

members |

|

|

Low and no down payment options

available |

|

|

Flexible income, debt and credit

requirements |

|

|

Down payment and closing costs

may come from a gift or grant |

|

|

Available in a variety of

fixed-rate and adjustable-rate

loan options |

|

|

You may add extra features such

as a temporary buydown |

|

|

|

|

|

CONVENTIONAL LOANS

|

|

Purchase higher priced homes |

|

|

Receive lowest interest rate possible

|

|

|

Minimum down payment 5%

|

FIRST TIME HOME BUYER ASSISTANCE PROGRAMS

FHA

203k HOME RENOVATION LOAN

REFINANCE

|

Capitalize on lower rates |

|

Convert an adjustable rate to a fixed

rate |

|

Reduce the term of your loan 25, 20, 15,

or 10 years |

|

Eliminate the need for mortgage

insurance |

|

Edward

Hull "E.H." Crump

|